Audience

- Sentiment: Neutral

- Political Group: Republican

- Age Group: Teenagers (14-19)

- Gender: Both genders

Overview

- President Trump is considering expanding tariffs on imports to boost the American economy by making foreign goods more expensive.

- The proposed tariffs could impact essential items like automobiles, pharmaceuticals, and semiconductors, potentially raising prices for consumers.

- The article explores the potential consequences of these tariffs on job creation, consumer prices, and the technology market.

Trump’s Tariff Talks: What You Need to Know and How It Affects You

In the ever-evolving world of politics and economics, a term you might hear a lot these days is “tariff.” But what exactly is a tariff, and why is President Donald Trump suddenly considering expanding them? Let’s dive into this complex topic, breaking it down so that it’s easy to understand and relevant to our lives as high school students.

What Are Tariffs, Anyway?

First of all, let’s clarify what a tariff is. A tariff is a tax that a government imposes on goods imported from other countries. Think of it as a fee that companies have to pay when they bring products into the U.S. from places like Japan, Germany, or China. President Trump has been a big believer in using tariffs as a way to boost the American economy. His idea is that by making foreign products more expensive, people will buy more American-made goods instead. This, in turn, is supposed to help create jobs and reduce trade deficits.

What’s New in Trump’s Plan?

Recently, Trump announced plans to expand these tariffs to include some pretty essential items: automobiles, pharmaceuticals (medications), and semiconductors (tiny computer chips that power everything from smartphones to electric cars). If you’re like most 9th graders, you might be rolling your eyes and thinking, “Why should I care about tariffs on semiconductors?” But hang on; this could affect your life more than you think.

Trump has suggested that these new tariffs could go as high as 25%. You’re probably asking yourself, “What does 25% even mean?” Let’s break it down: if a car that costs $20,000 has a 25% tariff slapped on it, the price would jump to $25,000. Suddenly, that shiny new car that everyone was eyeing becomes a lot less affordable. It’s not just cars, either; the same principle applies to medicines and electronics. And we’re not even sure which countries are going to be affected yet, which adds another layer of confusion.

Why Is Trump Doing This?

President Trump argues that by targeting these industries, he is encouraging foreign companies to move their operations to the U.S. This means they would build factories here instead of overseas. The hope is that this would create American jobs, improve the economy, and overall make America a “better” place to live and work.

However, this strategy raises some eyebrows, and for good reason. Imposing tariffs on pharmaceuticals could mean that the medicines you or your family rely on could become more expensive. Higher drug prices can lead to shortages. Imagine if your doctor prescribes a medicine for a chronic condition, and suddenly, that medicine is not only hard to find, but also costs a whole lot more. That’s a situation nobody wants.

The Semiconductor Dilemma

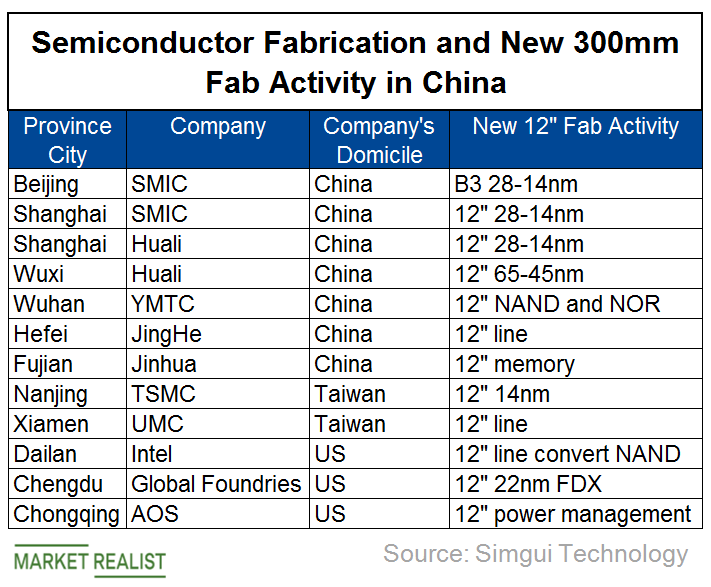

Let’s delve a bit deeper into the semiconductor market. These little chips are the backbone of our technological world. They are found in almost every electronic device we use daily—from our computers to our game consoles. Taiwan Semiconductor Manufacturing Company (TSMC) is one of the biggest players in the semiconductor industry, and they provide chips for many U.S. companies, including Apple and NVIDIA.

Now think about what would happen if there were new tariffs on these products. It could slow down the tech production timeline, which would impact everything from new iPhone releases to video game launches. Your favorite tech gadgets could become more expensive, or worse, they might not be available at all. The uncertainty around when these tariffs might be implemented only adds to the anxiety in the market.

Economic Consequences: Winners and Losers

When something like this happens in the economy, there are typically winners and losers. The winners might be American manufacturers who can charge higher prices for their products since foreign goods are now more expensive. However, the losers could include everyday consumers like you and me, who may have to pay more for cars, medicines, and gadgets.

It’s like a balancing act. While the goal may be to boost American jobs, the ripple effects can create challenges for those at the receiving end of these higher prices. Middle-class families might end up pinching pennies just to afford basic needs, while small businesses that rely on imported goods could find it challenging to keep their prices competitive.

What Does All This Mean for You?

As a 9th grader, you might feel disconnected from the hustle and bustle of politics and economics, but the decisions made at the top affect everyone. These tariffs could change the landscape of your future job market, alter the prices of your favorite products, and impact the way you live your daily life.

Take education, for example. If tech companies have to increase prices to cover the costs of tariffs, they may have less money to invest in educational or internship programs for students. This means fewer opportunities for you as you get closer to college or the job market.

Moreover, as you think about your future career, consider fields like engineering, medicine, or technology—careers that rely heavily on global partnerships and trade. If tariffs are implemented, it could affect collaboration between countries and slow down innovation, resulting in fewer jobs in fields that matter to you.

Wrapping It Up

The administration’s plan to expand tariffs is a big deal, and it’s essential to understand how it could affect your life both now and in the future. While the goal may be to support American jobs and industries, it’s crucial to consider the broader implications, especially concerning prices, supply shortages, and potential job limitations.

So, what do you think? Do you believe that expanding tariffs on imports is a good strategy for growing American jobs, or do you think it could hurt consumers and the technology you love? Share your thoughts in the comments below!