Audience

- Sentiment: neutral

- Political Group: moderate

- Age Group: 30-50

- Gender: both

Overview

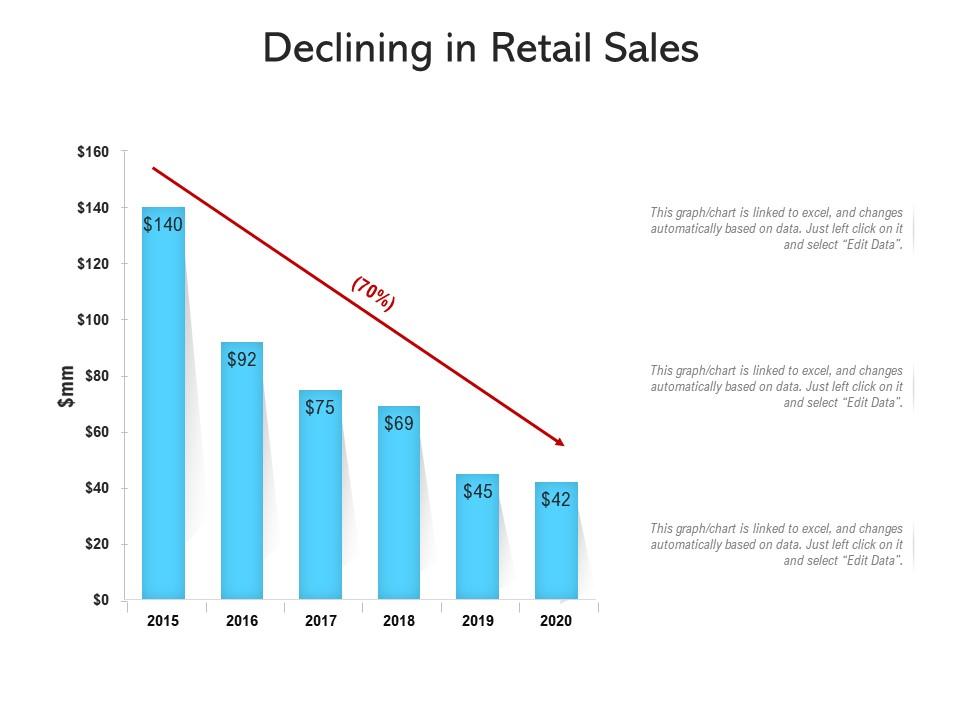

- American retail sales declined by 0.9% in January, marking the first drop since August 2023.

- Factors influencing the decline include ongoing inflation and severe weather conditions affecting shopping behavior.

- While retail sales are down, restaurants and bars have shown steady spending, reflecting consumer behavior under economic stress.

American Retail Sales: What Does a Decline Mean for Us?

Have you ever wondered how the money we spend affects the big picture of our economy? It might seem boring or complicated, but believe it or not, it’s like a giant puzzle where each piece matters. Recently, news hit that American retail sales dropped by 0.9% in January. This was the first decline since August 2023, which is significant because it tells us a lot about how consumers are feeling and how the economy is doing overall.

What Happened in January?

In January, a few factors came together to create this drop in retail sales. First off, inflation continues to loom large in the background. Inflation is when prices for goods and services rise, meaning every dollar you spend doesn’t go as far as it used to. While inflation has decreased from the crazy high levels we saw a year ago, it still hasn’t stabilized enough for consumers to feel completely secure about spending money.

You might be thinking, “Why should I care about this?” Well, let’s break it down. When people are worried about prices rising, they tend to hold on to their cash tighter. Imagine if you were saving for a new video game or a cool hoodie, but your friend told you that prices were going up. You might decide to save instead of spending, right? That’s what a lot of consumers are doing right now.

The Weather Really Matters

Another major factor affecting retail sales was the weather. If you’ve lived in a place where snowstorms or extreme temperatures hit hard, you know how that can turn plans upside down. When it snows heavily, or when it’s super cold, people are less likely to go out shopping. Instead, they might just stay home, sipping hot cocoa and binging their favorite series. Stores have less foot traffic, which means fewer sales.

Interestingly, the sectors that took the biggest hits were specialty stores and auto dealers. Think of specialty stores as places that sell unique items, like local boutiques or specialty shops for hobbies like gaming, crafting, or cooking. For auto dealers, fewer sales could mean people aren’t ready to make significant purchases like a new car. Instead, they might keep driving their older vehicles a little longer.

Good News for Restaurants and Bars

While many retailers experienced this decline, not every sector was affected equally. Restaurants and bars showed steady spending during this time. That might sound strange, right? One might assume people wouldn’t spend money eating out when they’re worried about money. But sometimes, people treat themselves when times are tough. Eating out can feel like a small escape from everyday stress. Maybe it’s the appeal of enjoying a meal with friends or the desire to taste your favorite burger from a local spot that keeps customers coming back.

The Importance of Consumer Confidence

So, why does this all matter? It ties back to something called “consumer confidence.” This is how optimistic or pessimistic consumers feel about the economy’s state and their financial situation. When people feel good about their jobs and their ability to spend money, they’re more likely to go out and shop. But when there are many worries – like inflation, job insecurity, or bad weather – consumer confidence takes a hit, and spending drops.

The decline in retail sales might seem like a huge problem, but experts say it could just be a temporary situation influenced by seasonal factors. Perhaps people were spending less this January because of colder weather or post-holiday exhaustion. After the holidays, many find themselves tight on cash since they spent a lot on gifts and celebrations. Therefore, it could simply be a matter of timing rather than a long-term change in how we, as consumers, behave.

What About the Federal Reserve?

Now, here’s where things get super interesting. The Federal Reserve, often referred to as “the Fed,” is a big player in managing the economy. It’s like the coach of our financial system. They influence interest rates, which can help keep the economy stable. Interest rates are what banks charge for loans. For instance, if you want to buy a car and you take out a loan, the interest rate determines how much extra money you’ll pay back along with the original amount you borrowed.

The Fed has been a bit cautious about raising interest rates lately because they want to see more evidence of economic stability. If consumers are feeling uncertain, raising interest rates might make it even harder for people to afford big purchases, which could further slow down spending. In simple terms, the Fed is trying to tread carefully while balancing the economy on a seesaw. If they’re not careful, they could tip it in the wrong direction.

Looking Ahead: What Will Happen Next?

Retail sales data will be crucial in the upcoming months. This information helps us peek into consumer behavior and how confident we feel about spending our money. Just like your performance in school might fluctuate with different subjects and assignments, so does consumer spending. By closely watching these sales figures, economists can gauge whether we are entering a period of increased spending or if we’ll continue to be cautious.

Experts suggest keeping an eye out for upcoming months to see if retail sales begin to recover. For instance, if spring arrives with milder weather, people may be more willing to go out and shop again. After being indoors during the cold winter months, many can’t wait to hit the shops or explore local markets. There’s just something refreshing about being outdoors when the weather feels great!

Conclusion: What Does This Mean for Us?

So, what can we take away from all this? The decline in retail sales is a significant event in the economy that has many interconnected parts. It reflects how we, as consumers, are feeling and the broader economic landscape. By understanding these concepts, you can better grasp not just what you see in the news but also how it relates to your life and your decisions.

Maybe next time you think about your own spending habits, consider how external factors – like the economy and the weather – influence your choices. Do you think you’d spend more money on a night out with friends instead of saving for that cool gadget if you felt more secure about your finances? Or would you still prioritize saving, hoping to wait for a better deal?

We want to hear your thoughts! What do you think about the decline in retail sales? Do you feel the impact of the economy in your shopping habits? Share your opinions and experiences in the comments below!