Audience

- Sentiment: Neutral

- Political Group: Conservative

- Age Group: 18-34

- Gender: All

Overview

- Inflation rose by 3% in January 2025, surprising many and impacting daily expenses.

- Key drivers of inflation include rising costs in groceries, housing, and energy.

- Economic implications of the inflation rate challenge President Trump’s policies, particularly as voters head to the polls.

The Inflation Surprise of January 2025: What It Means for Everyone

Imagine waking up one January morning in 2025 and realizing that you need to pay more for the things you used to buy without thinking twice. Your favorite snacks at the grocery store, the rent for your tiny apartment, and even the gas for your car are all suddenly costing way more than they did just a year ago. This was the surprising reality when, in January 2025, inflation skyrocketed by 3% compared to the previous year, taking many by surprise and causing quite a stir in the economic world. As we dive deeper into why this happened and what it means, let’s explore how this inflation affects regular people like you and me, and what it might mean for the future.

What is Inflation, Anyway?

Before we dig into what happened in January 2025, let’s clear up what inflation actually means. Inflation is basically when the prices of goods and services go up over time. If you think about it, if last year you could buy a candy bar for $1, but this year it costs $1.03, that’s inflation at work! A certain measure called the Consumer Price Index (CPI) tracks this change. It’s a bit like a shopping list that the government uses to see how much prices have gone up or down.

The January Shock: 3% Inflation!

In January 2025, we saw a 3% rise in the Consumer Price Index year-over-year. That’s significantly higher than what many experts were expecting! A lot of us don’t pay attention to economic jargon, but what this means is that many everyday expenses are getting more expensive, and it left a lot of people scratching their heads.

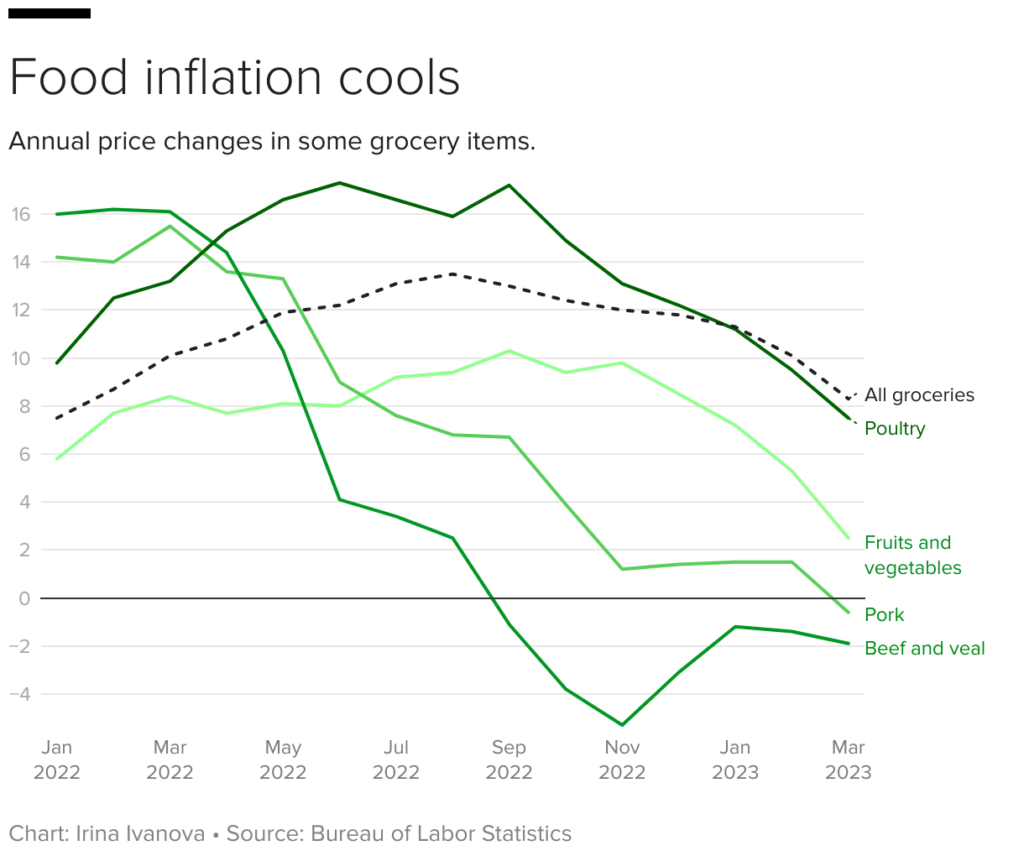

The main culprits for this inflation surge were rising prices on three key categories: groceries, housing, and energy. Let’s break that down a bit.

1. Groceries:

Coming back to the grocery store, the cost of food has been on the rise. Let’s talk about that favorite snack of yours. If you noticed that your favorite chips went from being $3 to $3.30, that’s a 10% increase! Over time, this can really add up, especially for families trying to manage their budgets. The rising prices are often due to different factors like bad weather affecting crops, transportation costs going up, or even problems in the supply chain.

2. Housing:

Housing is another huge factor. Rent prices for apartments and houses tend to be a significant part of everyone’s budget, especially for younger people just starting out. If you’re living on your own or planning to, imagine the stress of trying to find a decent place to live while the prices keep increasing. When it costs more to rent an apartment, a lot of personal finances have to shift, and it can lead to more people needing roommates or living at home longer than they’d want.

3. Energy:

Finally, let’s talk about energy, which includes things like the gas we put in our cars and the electricity we use at home. When energy prices rise, everything else tends to follow because businesses have to spend more on fuel and utilities, and they often pass on those costs to consumers like you and me.

The Impact on President Trump’s Policies

Now, let’s connect this inflation rise back to President Donald Trump. This economic situation has put his plans and policies under a microscope. As voters headed to the polls during recent elections, many were frustrated by the increasing cost of living. Nobody loves paying more for groceries or rent, and when you feel it in your pocket, it becomes a pressing issue.

Trump often pointed fingers at the previous Biden administration, blaming them for problems that were already brewing. However, this increase in inflation was happening while he was still in office, which poses a significant political challenge. Any political leader knows that when things start to go south economically, the blame game can impact their reputation and future.

The Federal Reserve’s Reaction

In light of all this inflation news, the Federal Reserve, often called the Fed, is in a tough spot. Their main job is to keep the economy balanced, and they usually keep an eye on inflation when deciding interest rates. A lot of people borrow money to buy houses and cars, so when interest rates are low, it’s cheaper to borrow money. But if inflation is on the rise, it’s risky for the Fed to cut rates too quickly because it might add more fuel to the fire.

A big part of the Fed’s strategy is to keep inflation in check while supporting economic growth. So, seeing inflation rise to 3% complicates their plans. If they cut interest rates too soon, it could cause even higher inflation down the road. It’s a delicate balance, and one that could set off more unpredictable economic repercussions.

Stock Markets and Financial Markets: The Turmoil

So how does this all play out on the stock market? Stock prices and bond yields took a hit following the news about inflation. Investors were worried about how rising prices would affect businesses, leading to skepticism about future profits. When companies struggle, stock prices often follow, sometimes plummeting as people pull their investments out. It’s like a chain reaction—a bit like that game where you pull out one block from a tower and it all comes crashing down.

What It Means for the Future

With inflation being so high, what does it mean for the future? Well, it could mean more political challenges for Trump and his administration. If people are unsatisfied with rising costs, it could affect how they vote in the next elections. People want leaders who can manage the economy and take steps to ensure affordable living standards.

Meanwhile, regular folks like us need to be on the lookout. Knowing these trends helps us plan things like our budgets and savings. Maybe it means cooking more at home instead of dining out or reconsidering how to spend our money wisely.

It’s essential to pay attention to these economic changes, as they affect everything from our daily lives to major political decisions. Whether you’re a senior in high school preparing to head off to college or someone considering their future career path, understanding these concepts can help you stay ahead.

Final Thoughts

So here’s the million-dollar question: where do we go from here? Will the prices continue to rise, or will the economy stabilize? What do you think about how inflated prices might affect your plans for the future?

I’d love to hear your thoughts! What are your experiences with rising prices, and how do you think it will impact your life in the coming years? Drop a comment below!