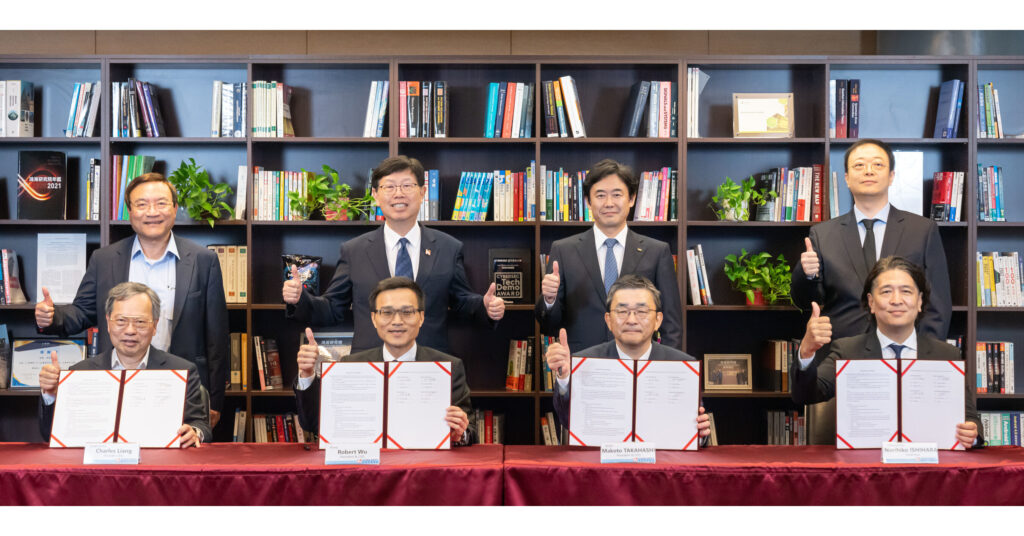

From left to right in the first row are Charles Liang, President and CEO of Supermicro; Robert Wu, President and CEO of SHARP; Makoto Takahashi, Chairman of KDDI; and Norihiko Ishihara, Chairman of Datasection. (PRNewsfoto/Super Micro Computer, Inc.)

Audience

- Sentiment: Positive

- Political Group: Neutral

- Age Group: 25-40

- Gender: Mixed

Overview

- Super Micro projected a 54% revenue increase due to AI-related product demand.

- The company faces some challenges but maintains an optimistic outlook for the future.

- Plans for a $700 million private placement aim to support expansion in innovative technologies.

Super Micro’s Q2 2025 Earnings Call: What You Need to Know About Their Financial Future

Have you ever wondered what goes on behind the scenes of big tech companies? How they plan their moves, deal with challenges, and celebrate successes? Recently, I got a peek into one of those behind-the-scenes moments during Super Micro’s earnings call for the second quarter of fiscal 2025. This isn’t just about numbers and charts; it’s about an exciting journey into the world of high-tech products, especially AI-related innovations, and how a company plans to not just survive but thrive.

The Surge of Revenue

Super Micro’s CEO, Charles Liang, and CFO, David Weigand, kicked off the earnings call with some exciting news about the company’s revenue. They projected that Super Micro would earn between $5.6 billion and $5.7 billion for the second quarter, representing a huge 54% increase compared to last year. Just think about that—growing by over half in just one year! This growth has been primarily driven by a surge in demand for AI-related products. AI, or artificial intelligence, is a hot topic these days. It’s everywhere, from the chatbots we interact with online to self-driving cars. The fact that a company like Super Micro is benefitting from this trend shows just how much the world is leaning into AI solutions.

But why the big demand for AI products? Imagine you have smart devices at home that learn your habits and predict your needs, like turning on the lights when you walk into a room or suggesting movies based on your preferences. That’s AI working its magic! As businesses look to harness the power of AI, they need the right infrastructure, and that’s where Super Micro comes in. They provide the necessary tools and hardware that allow companies to implement AI solutions effectively.

Overcoming Challenges

However, it wasn’t all smooth sailing. Liang addressed some challenges the company faced, particularly the delay in their 10-K filing, which is a detailed annual report that publicly traded companies must file. This delay influenced their cash flow—essentially, how money was moving in and out of the company. But don’t worry; the company still sounded optimistic about bouncing back. Liang reassured investors and analysts that they were navigating these challenges, and it’s just part of the business cycle. Every company faces bumps in the road; it’s how they deal with those bumps that often sets them apart.

Moving Forward with Innovation

One of the most exciting parts of the earnings call was when Liang talked about technology transitions, specifically the company’s move from their Hopper to Blackwell GPUs. In layman’s terms, a GPU, or Graphics Processing Unit, is essential for handling graphics in computers and is crucial for AI processes. Transitioning to better technology helps Super Micro stay competitive and harness advances in processing power, which is immensely valuable in the AI space. When tech companies launch new generations of products, they’re not just changing their line-up—they’re often setting the stage for the future of technology itself.

Liang’s focus on data center solutions also caught my attention. You can think of data centers as the backbone of the internet, where lots of information is stored and processed. The more powerful and efficient the data center, the better services they can provide to customers. Super Micro aims to enhance these data centers with more innovative solutions, something that could significantly benefit businesses worldwide.

Big Plans for Funding and Expansion

Super Micro is making big strides forward, and to further enhance their growth, they announced plans for a private placement of $700 million in convertible notes. Okay, this might sound complex, but let’s break it down. A convertible note is essentially a type of loan that a company can offer to investors. The cool part is that these notes can be converted into company stock later. This smart financial move is designed to support Super Micro’s ongoing expansion, especially in areas like liquid cooling technologies. Liquid cooling might sound like something out of a sci-fi movie, but it’s a practical solution to keep servers and processors cool when they’re working hard. Think of it like a cooling system for your computer that helps it run faster and more efficiently.

Setting High Revenue Goals

What is all this leading to? Super Micro is not just content with their current achievements; they have ambitious goals. They anticipate reaching a revenue target of $23.5 billion to $25 billion for fiscal year 2025, with sights set on possibly hitting $40 billion in fiscal year 2026. That’s not just a stretch goal; it’s jumping into the stratosphere! I can’t help but admire that level of ambition. It shows a clear vision of where they see themselves in the market and how the company plans to leverage the growing demand for AI infrastructure.

An Optimistic Outlook

Towards the end of the earnings call, both Liang and Weigand hinted at a bright future. With increasing global investment in AI infrastructure, Super Micro is in prime position to ride this wave of demand. Countries around the world are pouring money into technology, especially as more businesses recognize the necessity of AI to improve their operations and services. The optimistic outlook not only comes from their current earnings but also from a strong and evolving market that shows no signs of slowing down.

Why It Matters

So, why should students—a group that often feels detached from corporate earnings calls—care about this? Well, this information is not just for business majors or finance geeks. Super Micro’s story illustrates how quickly the tech industry evolves, how innovation drives economic growth, and how companies adapt to changes in consumer demand. Plus, it highlights potential career paths in AI, technology, and business that students might not think about.

We are living in a time when technology is the heartbeat of everything we do, and understanding how tech companies operate can help you make informed decisions in your future career or investments. And if you think about it, one day, you might work for a company like Super Micro or another technology giant, and knowing about their challenges and successes could inspire you to innovate and push boundaries yourself.

What Do You Think?

Super Micro is clearly aiming for the stars, and it’s fascinating to see how they plan to reach their goals. Their journey reflects not just the potential of AI technology but also the resilience required to navigate the ups and downs of a dynamic market.

Now, I want to hear from you! What do you think about Super Micro’s plans for the future? Do you believe that AI is the next frontier for technology? Leave a comment below and share your thoughts!