Audience

- Sentiment: Neutral

- Political Group: Moderate to Conservative

- Age Group: Young Adults (18-34)

- Gender: Both male and female

Overview

- Jerome Powell emphasizes no urgency for rate cuts despite a strong job market.

- Inflation remains a key concern, potentially affecting monetary policy decisions.

- The Federal Reserve’s independence is crucial for sound economic decision-making.

Title: Federal Reserve’s Jerome Powell: No Urgency for Rate Cuts Amid Strong Job Market

In a world where money plays a crucial role in our daily lives, the decisions made by those in charge of the economy can affect everyone, from the richest corporations to everyday families trying to make ends meet. One of the key figures in managing the U.S. economy is Jerome Powell, the Chair of the Federal Reserve (often just called the Fed). Recently, he addressed the Senate Banking Committee, sharing important insights about our economy, interest rates, jobs, and inflation.

So, what does all of this mean, and why should you care? Let’s break it down!

What Are Interest Rates, and Why Do They Matter?

First, let’s talk about interest rates. You might be familiar with them if you’ve ever taken out a loan to buy a car or pay for college. When you borrow money, the lender usually charges interest on the amount you borrow. If interest rates are high, borrowing money becomes more expensive. This can discourage people from taking out loans for big purchases like houses or cars. On the other hand, if interest rates are low, it’s cheaper to borrow money, which can encourage people to spend more.

The Federal Reserve plays a key role here. They set these interest rates to help control the economy. If the economy is growing too fast and prices are rising (this is called inflation), the Fed might increase interest rates to slow things down. Conversely, if the economy is sluggish, the Fed might decrease rates to encourage borrowing and spending.

The Job Market: A Strong Indicator

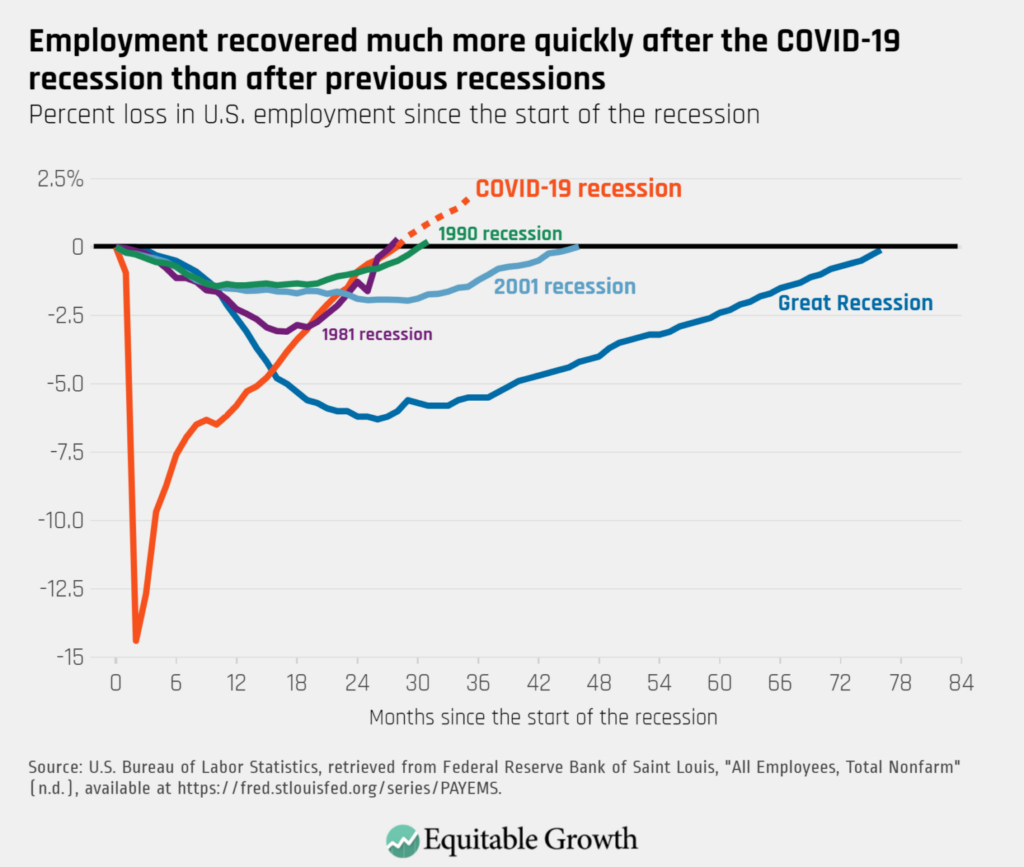

During his testimony, Powell pointed out that the job market is doing really well. When people have jobs and are earning money, they tend to spend more, which fuels the economy. This means businesses have more customers, and in turn, they often hire more workers. It’s a cycle that can lead to economic growth.

However, Powell indicated that despite the strong job market, the Fed isn’t in a hurry to cut interest rates. Why? It’s important to know that just like a plant needs both water and sunlight, the economy needs a balance of factors to thrive. While a strong job market is great, Powell is also concerned about inflation—when prices rise and money doesn’t go as far as it used to. If inflation remains high, cutting interest rates might not be the best move, even if more people are employed.

The Inflation Puzzle

Inflation has been a hot topic lately. Imagine going to the store and seeing that your favorite snack now costs a dollar more than it did last year. That’s inflation in action! When prices for everyday goods and services keep rising, it erodes the purchasing power of your money.

In his comments, Powell mentioned that they have already made a reduction of one percentage point in interest rates over the past year. However, he stated it was important to wait and see how inflation behaves before making further cuts. If inflation cools off, it might be more appropriate to adjust the rates. But if prices continue to rise, cutting rates could exacerbate the problem, leading to even higher inflation.

Independence of the Federal Reserve

One interesting aspect of Powell’s testimony was his strong emphasis on the independence of the Federal Reserve. In simple terms, this means that while the Fed works closely with the government, it should be able to make its own decisions without political pressure.

This became especially relevant when senators asked about President Trump’s policies, particularly the tariffs imposed on imports. Tariffs are taxes on goods coming from other countries, and they can lead to higher prices for consumers. Powell avoided any direct comments on the president’s policies, instead focusing on keeping the Fed free from political influence. This independence is crucial for making sound economic decisions that are best for the country without being swayed by political agendas.

The Impact of Crypto and Financial Regulations

Another key point raised during the testimony was the discussion around cryptocurrencies, like Bitcoin. As technology evolves, so does the financial landscape, and with it, new challenges for regulators like the Federal Reserve. Some senators expressed their concerns regarding how the Fed supervises financial institutions, especially those in the ever-growing crypto industry.

Cryptocurrencies can create complications for central banks because they operate outside traditional banking systems. This means that regulators need to adapt and develop new ways to ensure that financial institutions are operating safely and transparently. Powell acknowledged the importance of reviewing and updating the Fed’s supervisory practices in this area.

Consumer Protections in Question

Alongside these discussions, Senator Elizabeth Warren raised concerns about consumer protections. Consumers are ordinary people like you and me. When we take out loans, use credit cards, or engage in any financial transactions, we rely on regulators to protect us from unfair practices.

Warren criticized the Trump administration’s approach to the Consumer Financial Protection Bureau (CFPB) and cautioned against weakening the protections that safeguard consumers. She believes that without strong regulations, consumers could be vulnerable to predatory lending or unfair financial practices. Powell’s acknowledgement of these concerns indicates that there is a need for a careful approach to balance financial innovation with consumer safety.

A Cautious Path Ahead

Overall, Jerome Powell’s remarks reflect the careful balancing act that the Federal Reserve must perform. With a strong job market giving hope for economic growth, the continued challenge of persistent inflation means that any rush to cut rates could backfire. The Fed’s independence allows it to navigate these complex decisions free from political pressure, making it a crucial player in the economy.

As we look forward, it’s important to realize how these decisions impact our lives. From the cost of groceries to the interest rates on student loans, the choices made by the Fed affect us all.

Get Involved in the Conversation!

As young people, you have a stake in how the economy evolves. Whether you’re thinking about your first job, saving for college, or planning for your future, understanding these economic discussions is key to making informed decisions. What do you think about Jerome Powell’s approach? Do you agree with him that we shouldn’t rush to cut interest rates, or do you think a different course of action might be better?

Feel free to share your thoughts in the comments below!