Audience

- Sentiment: Positive

- Political Group: Moderate to Conservative

- Age Group: 18-35

- Gender: Mixed

Overview

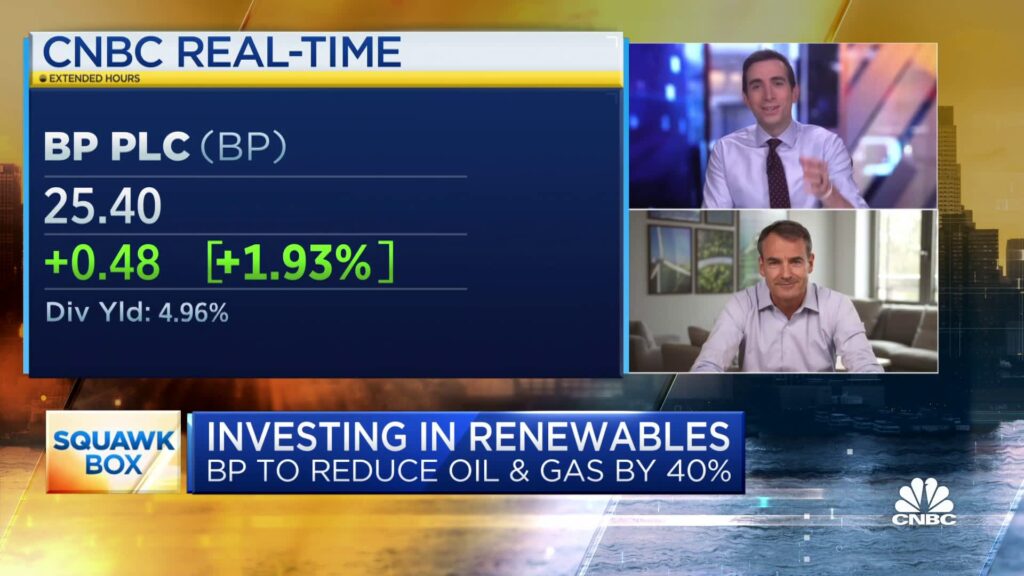

- BP shares increased by almost 7% due to speculation about Elliott Management’s involvement.

- Elliott Management is known as an activist investor likely to push for strategic changes at BP.

- The energy sector is shifting towards renewable sources, affecting traditional companies like BP.

BP Shares Surge Amid Elliott Management Stake Speculation: What’s Going On?

In the world of finance and big business, names like BP and Elliott Management can feel super complicated. But they play a huge role in the economy and, believe it or not, in our everyday lives, too! Recently, BP’s shares saw a big jump—almost 7%—because of some buzz involving Elliott Management, a well-known investor group. Let’s break it down and look at why this is so important, what it might mean for BP, and why we should care.

What’s Happening with BP?

First off, let’s talk about BP. BP, which stands for British Petroleum, is one of the world’s largest oil and gas companies. They’re the folks behind a lot of the gas stations you see around town and are involved in drilling oil from the ground and providing energy to millions. However, BP has faced some big challenges recently. Over the past year, their stock—basically, a small piece of the company that you can buy—has dropped about 9%. That’s not great news if you’re an investor or if you work for the company.

Recently, BP caught everyone’s attention because of rumors surrounding Elliott Management. This company is known as an “activist investor.” This essentially means they buy shares in other companies like BP and push for changes that they believe will make the companies more profitable or improve their overall performance. Activist investors can shake things up, and that’s exactly what they seem to be planning with BP.

Who is Elliott Management?

Before we dive deeper into what might happen with BP, let’s take a closer look at Elliott Management. Founded by a guy named Paul Singer in 1977, Elliott Management is one of the oldest and largest hedge funds in the world. Hedge funds are kinds of investment groups that use complex strategies to try to make money for their investors. Elliott has a reputation for being a tough negotiator and is known for taking an active role in the companies in which they invest.

Elliott Management has been involved in various high-profile campaigns to push companies to change their approaches, make better profits, or even replace their leadership. When Elliott gets involved, it often means that the company in question can expect a lot of scrutiny (that means people watching closely and asking tough questions). Now that you have a little background, let’s dig into what this means for BP.

The Impact on BP

So, back to BP. The increase in their stock price after Elliott Management acquired a stake suggests that investors are hopeful about what changes may come as a result. What exactly does this mean? Well, it could mean several things:

- Reevaluation of Strategies: One major thing that Elliott might do is push BP to reevaluate its business strategies. That could involve focusing more on profitable areas of the oil and gas industry or even investing more in renewable energy sources, which are becoming increasingly important as the world tries to combat climate change.

- Leadership Changes: Activist investors like Elliott often think that change is good. This could mean asking for new leadership at BP, perhaps someone they believe can steer the company in a better direction or react quicker to the ongoing shifts in the global energy market.

- Cost Management: BP has warned investors that it might face higher costs in the near future. Activist investors typically want to make sure companies manage their resources wisely, so they may push BP to cut unnecessary costs or streamline operations.

- Focus on Profits: Ultimately, Elliott’s involvement is likely motivated by the desire to increase BP’s profitability. They may examine BP’s operations to identify areas where the company can make more money and find new ways to satisfy their investors.

A Time of Change in the Energy Sector

It’s essential to understand that the energy sector is undergoing a significant transformation. The push for renewable energy sources like wind and solar power is becoming more pronounced. This means oil companies like BP are not just competing with each other, but they’re also facing pressure to adapt to a world that’s looking more toward clean energy solutions. This change is challenging for traditional companies that have relied on oil and gas for decades.

With companies around the world making commitments to reduce carbon emissions and move towards more sustainable practices, BP has also commented on its plans for the future. However, their specific strategies haven’t always resonated well with investors, and that’s where Elliott might come in to rally support for some more aggressive changes.

What’s Next for BP?

The upcoming months will be crucial for BP. They are expected to release their fourth-quarter results and outline their long-term strategies, which will be closely watched by analysts and investors alike. Everybody will want to hear how they plan to tackle the challenges they face, especially with low oil prices affecting their bottom line.

It’s also important to remember that as BP navigates its path, it is not alone in this journey. Other large oil companies are also making moves to adapt to the new demand for green energy. For example, companies that were once solely focused on oil drilling are starting to branch out into renewable resources. BP’s challenge will be to balance its ongoing operations in oil and gas while also transitioning toward a greener future.

Why Should We Care?

Now you might be wondering, why should any of this matter to you? Well, there are several reasons why the happenings with BP and investors like Elliott Management could touch our lives as high school students.

- Jobs and Economy: The health of major companies like BP can affect job stability and openings in the energy sector. If BP does well, they might hire more people, which is good news for future job seekers.

- Environmental Impact: As BP and other companies shift toward renewable energy, the long-term effects could include cleaner air and a healthier planet. If you care about the environment (which a lot of young people do!), then changes at BP could mean positive steps toward a more sustainable future.

- Understanding Business: The world of stocks, investments, and market strategies can seem really complicated, but it’s part of our economy and influences many industries. Understanding how these businesses operate will make you smarter about the world around you as you grow up and possibly consider your future career.

- Empowerment: Knowledge is power! By understanding what’s happening in big companies and the moves investors make, you can make more informed choices about your own finances one day.

Conclusion

In conclusion, BP’s surge in stock price amid speculation about Elliott Management’s involvement presents an intriguing scenario in the financial world. It raises questions about the future direction of one of the largest oil companies. As BP looks to balance its traditional oil and gas business with a growing commitment to renewable energy, the influence of Elliott and other activist investors could play a significant role in shaping its strategy.

So, what are your thoughts about these corporate changes? Do you think BP should focus more on renewable energy, or should they stick with oil and gas for now? I’d love to hear your opinions in the comments below!